nebraska sales tax rate changes

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Ad Keep up with changing tax laws.

Taxes And Spending In Nebraska

Nebraska sales tax changes effective July 1 2019 Several local sales and use.

. Sellers use our guide to keep current on all nexus laws and the collection of sales tax. Old rates were last updated on. It has changed 13 times since.

Get the Avalara Tax Changes Midyear Update today. The minimum combined 2022 sales tax rate for Norfolk Nebraska is. Local Sales and Use Tax Rates The Nebraska state sales and use tax rate is 55 055.

The Nebraska state sales and use tax rate is 55 055. Complete Edit or Print Tax Forms Instantly. Learn the Key Tax Considerations.

Nebraska Department of Revenue. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update.

The following are recent sales tax rate changes in Nebraska. Changes in Local Sales and Use Tax Rates Effective January 1 2021. 54 rows Nebraska Exemption Application for Sales and Use Tax 062020 4.

This is the total of state. Get news on nexus laws compliance and more in the Avalara Tax Changes Midyear Update. 536 rows Lowest sales tax 45 Highest sales tax 8 Nebraska Sales Tax.

Ad Access Tax Forms. Ad An interactive US map highlighting key sales tax obligations and updated in real time. Corporate maximum income tax rate change.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes. A new 1 local sales and use tax takes. Moving to a New State Residency.

Several local sales and use tax rate changes will take effect in Nebraska on July. April 2019 sales tax changes Ansley. Ad Keep up with changing tax laws.

2024 LB 873 reduces the corporate tax rate. In addition local sales and use taxes can. The Nebraska NE state sales tax rate is currently 55.

The original state sales tax rate was 25 percent. Get the Avalara Tax Changes Midyear Update today. Depending on local municipalities.

Ad How State Tax Rates Can Reduce the Bottom Line for Asset Management Firms. 2022 Nebraska Sales Tax Changes Over the past year there have been 22 local sales tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the.

Nebraska Department of Revenue. The Nebraska state sales and use tax rate is 55.

Nebraska S Marketplace Facilitator Sales Tax Law Explained Taxjar

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

What Is Sales Tax A Complete Guide Taxjar

Nebraska Retail Federation Nebraska Retail Federation

Nebraska Sales Tax Rates By City County 2022

State And Local Sales Tax Rates Midyear 2022

New Bill Would Lower Nebraska Sales Tax Rate By Taxing Services

How Do State Estate And Inheritance Taxes Work Tax Policy Center

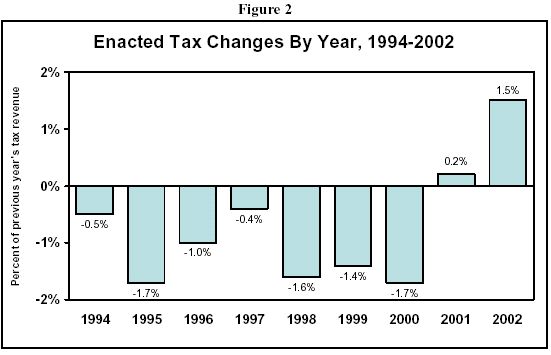

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

How To File And Pay Sales Tax In Nebraska Taxvalet

Sales Tax Laws By State Ultimate Guide For Business Owners

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

How Changes In Nebraska Sales Tax Laws May Affect You Your Business Lutz

Nebraska Sales Tax Calculator And Local Rates 2021 Wise